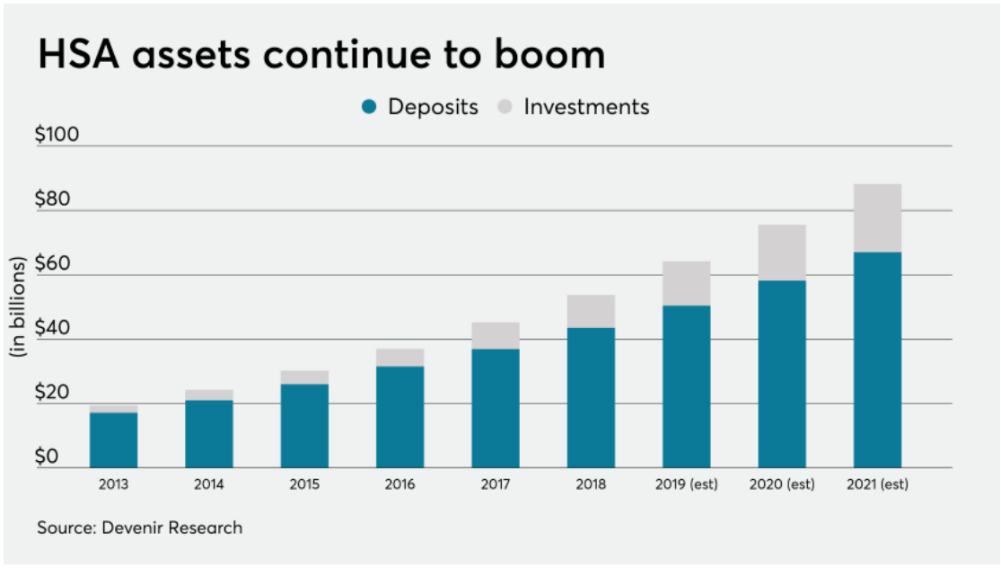

As more consumers are taking advantage of HSA accounts, account assets grew to over $60 billion in mid-2019. Why are these accounts gaining? Employers are realizing the value of offering a High Deductible Health Plan (HDHP) with a Health Savings Account (HSA). Increased employer contributions are spurring more eligible employees to open HSA accounts. Consumers facing swelling PPO plan deductibles are considering HDHPs as a viable plan alternative. Adoption rates are up, perhaps due to increased consumer fluency surrounding the portability of these accounts and the potential for accumulating balances which can be used for long-term healthcare needs throughout retirement years.

Although HSA metrics are up and poised for more growth, there are still some hindrances to success. Recent research shows that consumer knowledge is still lagging and many are missing out on maximizing the features of their HSA accounts. It’s been estimated that over 50% of HSA holders are not aware that they have an investment feature on their account.

TRI-AD’s HSA administration services will help consumers understand how to get full use of their HSA through tailored communications, “explainer” videos, a guided portfolio, and a consistent and targeted communication plan. We will partner with you to help educate your workforce.

TRI-AD’s engagement plans help consumers understand:

- The purpose of their HSA and how it works

- How investing their HSA funds helps maximize the value of their account

- How our HSA Guided Portfolio tool can help consumers invest and manage HSA funds with: a risk tolerance questionnaire, investment allocation tools, automatic rebalancing, and portfolio management “auto-pilot” features.

Integrated health and wealth solutions. That’s the TRI-AD difference.

Please contact your Client Service Manager or sales@tri-ad.com for additional information.

TRI-AD and our Associates’ suggestions or recommendations shall not constitute legal advice. No content on our website can be construed as tax or legal advice and TRI-AD may not be considered your legal counsel or tax advisor. Clients are encouraged to consult with their tax advisor and/or attorney to determine their legal rights, responsibilities, and liabilities. This includes the interpretation of any statute or regulation, federal, state or local; and/or its application to the clients’ business activities.