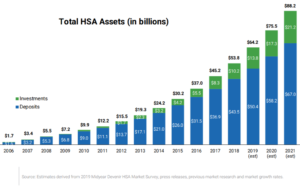

Your Health Savings Account (HSA) is touted as a powerful tool to help reduce your tax obligations and save for qualified expenses now and in the future. But did you also know your HSA can give your overall retirement savings a boost? HSAs offer amazing tax benefits and investment choices similar to a 401(k) or Roth IRA. However, HSA investment components are not being utilized by over 95% of accountholders according to Devenir’s 2019 Midyear HSA Market Statistics & Trends report. It’s also been estimated that over 50% of consumers are not confident making investment selections as they lack knowledge and experience.

TRI-AD makes HSA investing fast, simple, and easy with our HSA Guided Portfolio. This tool assists consumers with important decisions like what mutual funds to select and how often they should rebalance their portfolio. By providing a few basic responses, the consumer will be presented with a custom asset allocation that fits into their life and HSA investment goals.

Best of all, consumers can enroll in auto-rebalancing to make sure their portfolio stays on track with their chosen asset allocation strategy, which can be revised at any time. Our digital investing tools can help create confident consumers who are pursuing healthier financial well-being.

Integrated Health and Wealth Benefits Administration. That’s the TRI-AD Difference.

Click for Quick Video on TRI-AD’s HSA Guided Portfolio