The after-tax feature in a 401(k) plan can be extremely beneficial especially for those employees who are highly compensated. That is if your plan allows for it and employees understand how it works. Many employees are familiar with the elective deferral contribution limit but there is a lesser-known non-Roth after-tax feature that can allow participants to save additional money for retirement.

Let’s first look at the two main contribution limits that are set annually by the IRS:

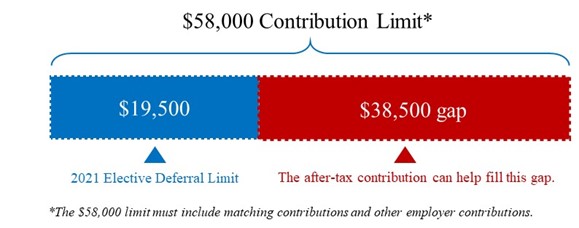

- 402(g) limit (elective deferral limit) – This limits the amount of elective deferrals a participant may exclude from their taxable income in a given taxable year. For 2021, the limit is $19,500 plus $6,500 catch-up if you’re age 50 or older, for a total of $26,000. For 2022, the limit is $20,500 plus $6,500 catch-up if you’re 50 or older, for a total of $27,000.

- 415 contribution limit – This limits the amount of employer and employee contributions. For 2021, the limit is $58,000 ($64,500 if you’re age 50 or older). For 2022, the limit is $61,000 ($67,500 if you’re age 50 or older).

How does the after-tax feature work?

After-tax contributions are a separate bucket of money which is different from traditional pretax and Roth contributions. Much like a Roth feature, the after-tax contribution is subject to income tax in the year of contribution, and money in the account grows on a tax-deferred basis. However, what sets the after-tax contribution apart from the Roth is at the time of distribution the investment gains are taxed as ordinary income.

The after-tax contributions are not considered to be “deferrals” and are not subject to the $19,500 limit. Rather, they are subject to the overall contribution limit of $58,000. If the plan allows for it, higher-income earners can utilize the after-tax contributions in their 401(k) plan to help fill the gap once the elective deferral $19,500 contribution limit has been reached.

Mega Backdoor Roth IRA

For a participant who has already maxed out the $19,500 pretax or Roth 401(k) contribution limit and is allowed to make an additional after-tax contribution, this is where the mega backdoor Roth IRA strategy comes in. The strategy is to convert the after-tax contribution account immediately to a Roth account so that accumulated earnings in the converted Roth account may be exempt from taxation when distributed. In order to convert after-tax contributions to a Roth account, an individual may be able to withdraw their after-tax contributions quickly after making them, pay income tax on any earnings, and convert the money to a Roth IRA. Another option is to convert an after-tax contribution account to a Roth account within the retirement plan if the plan allows for this type of conversion.

After-Tax Contribution Considerations

After-tax contributions can be a helpful tool, however, overall utilization is relatively low. According to Vanguard, fewer than 20% of 401(k) plans provided after-tax contributions in 2019. Often plan sponsors may not even be aware this feature exists or that they are even offering it.

The biggest hurdle to adding an after-tax contribution feature to a retirement plan is that the after-tax contributions are subject to the Actual Contribution Percentage (ACP) test. This test for 401(k) plans compares the rate of matching and after-tax contributions made by highly compensated employees (HCEs) to the rate made by non-highly compensated employees (NHCEs) to ensure the contributions are considered nondiscriminatory. Generally, HCEs can defer on the average 2% above the NHCEs. The employees most likely to make after-tax contributions are highly compensated employees, so the ACP test is likely to fail. The fix is to return the excess after-tax money to HCEs. This is why many plan sponsors have not allowed after-tax contributions. The ACP test is also required if after-tax contributions are made to a safe harbor plan where nondiscrimination testing is usually avoided.

Although the after-tax contribution is a powerful feature that can help get participants on track for retirement, be aware of the additional testing requirements involved. More administrative oversight may be needed when implementing this feature. All after-tax contributions are counted in the ACP percentage for employees using this option, so putting a limit on how much employees contribute may be needed.

Congress is currently looking to disallow the conversion of after-tax accounts to Roth accounts in the Build Back Better budget reconciliation legislation. Also, high-income taxpayers may be further restricted and may not be able to convert or roll over any non-Roth accounts into Roth IRAs or into a Roth account within a retirement plan. A high-income taxpayer is a taxpayer with adjusted taxable income of more than $400,000 for single filers, more than $450,000 for married filers, and more than $425,000 for head of household filers (all amounts will be adjusted with cost-of-living). If passed, these changes could become effective in 2022.

Your TRI-AD Client Service Manager is available to help you answer any questions you may have about 401(k) after-tax contributions.

TRI-AD and our Associates’ suggestions or recommendations shall not constitute legal advice. No content on our website can be construed as tax or legal advice and TRI-AD may not be considered your legal counsel or tax advisor. Clients are encouraged to consult with their tax advisor and/or attorney to determine their legal rights, responsibilities, and liabilities. This includes the interpretation of any statute or regulation, federal, state, or local; and/or its application to the clients’ business activities.