Retirement readiness is a significant concern for nearly two-thirds of U.S. employees. Many Americans are not adequately prepared for retirement. In fact, according to a recent AARP study, about 1 in 4 US adults age 50+ say they do not think they will ever be able to retire. According to the 2022 Federal Reserve’s most recent Survey of Consumer Finances, the median retirement savings for those aged 55 to 64 is $185,000, when it should be at least $506,000*.

According to the US Chamber of Commerce, only about a third of small businesses offer a retirement plan, and about 47% of Americans work for small businesses. Many small businesses do not believe that they have the resources or expertise on hand to provide employees with an employer-sponsored retirement plan. Nathan Glassey, Director of Federal and State Legislative Affairs and Executive Director of the National Tax-Deferred Savings Association with the American Retirement Association, states, “state-mandated Auto-IRA programs were introduced to address the retirement plan coverage gap, especially for small businesses that struggle to set up their own retirement plans.” Glassey noted research shows people are more likely to contribute to retirement plans if they have access to a plan sponsored by their employer.

How These Plans Started

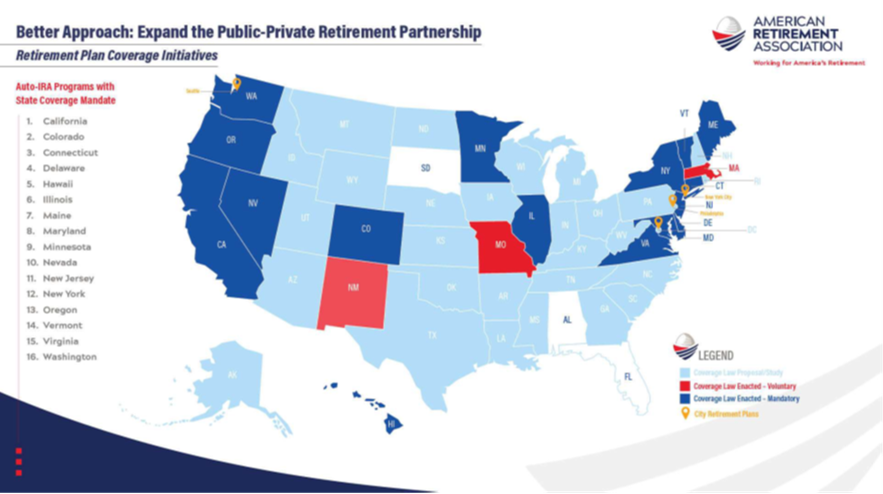

The genesis of state-mandated Auto-IRA programs can be traced back to Oregon, which implemented the first program in 2017. The program’s success encouraged other states to adopt similar initiatives. The implementation timeline for these programs varies for each state, with some already up and running while others are still in the early stages.

The overarching goal is to provide a retirement savings option for small business employees who otherwise would not have access to such plans. As states start to adopt these Auto-IRA programs, an increase in new employer-sponsored retirement plans has occurred as employers take steps to move forward with their own retirement plans.

State-mandated Auto-IRA program participation is generally suitable for businesses with fewer than 50 employees who would not be able to offer any other type of retirement plan to their employees. However, the plans can be implemented for companies of all sizes.

Glassey notes, “While traditional 401(k) plans offer more customization and higher contribution limits, state-mandated Auto-IRA programs provide a valuable option for small businesses and individuals who otherwise would not have access to employer-sponsored retirement plan savings.” However, many of the nay-sayers are unhappy with the current annual contribution limit of $7,000 per year ($8,000 for those 50+) for the IRA vs. $23,000 ($30,500 for those 50+) for a 401(k) plan. According to the Bureau of Labor Statistics, the average annual salary at the end of 2023 was $59,384, and the average 401(k) employee contribution rate is 7.4%. Doing the math, that is about $4,400 a year in contributions – well under the IRA contribution limit.

There are a number of benefits for participating employers and employees to adopt the state program including the following:

Participant Benefits:

• State-mandated programs help close the retirement plan coverage gap for Americans who may not have previously had access to one.

• Participants can contribute to the program through payroll deductions, making it convenient and easy to save for retirement. If they don’t pay themselves first off the top of their paychecks, they don’t save for retirement.

• Participants can choose their investment options within the program, although the choices may be more limited than those in traditional 401(k) plans.

• The programs encourage financial literacy and retirement readiness by providing access to retirement education and resources.

Employer/Plan Sponsor Benefits

• Employers may receive financial incentives or subsidies from the state to cover the initial costs of setting up the program and costs are typically minimal.

• The programs are designed to be user-friendly, with simple setup processes.

• State-run websites provide resources and information to help participants manage their accounts and make informed decisions about their retirement savings.

The state-sponsored Auto-IRA program may be a great solution for smaller employers with limited resources, helping boost retirement readiness for their employees. For employers who want to sponsor a more robust retirement plan, TRI-AD provides a wide range of options, from simple, structured, inexpensive 401(k) options to highly customized retirement plans. We encourage you to reach out to our team to see how we might be able to help you select the right plan for your business or improve the plan you already have in place.

* Methodology: Using the median income of $63,310, multiplied by a factor of 8 – Fidelity’s benchmark of savings guidelines for this age group.

TRI-AD and our Associates’ suggestions or recommendations shall not constitute legal advice. No content on our website can be construed as tax or legal advice and TRI-AD may not be considered your legal counsel or tax advisor. Clients are encouraged to consult with their tax advisor and/or attorney to determine their legal rights, responsibilities, and liabilities. This includes the interpretation of any statute or regulation, federal, state, or local; and/or its application to the clients’ business activities.