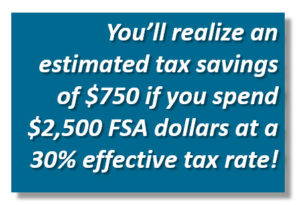

The tax advantages of FSA, HSA, and HRA accounts can help consumers save money. During this year’s annual enrollment period, many of us will be taking a more focused look at our finances and healthcare choices considering the experiences of the past 18 months. Educated consumers who understand how their employer’s benefits work are significantly more satisfied with their benefit experiences than those who do not. Let’s dig in to take a look at how these accounts differ to help consumers make the right choice to maximize their dollars!

FLEXIBLE SPENDING ACCOUNT (FSA)

An FSA is a spending account for certain eligible expenses. Typically, an account holder only has one year to spend FSA money and unused funds are returned to the employer at the end of the plan year. The maximum FSA contribution in 2021 was $2,750 for each qualified account. Some employers offer options like a carryover of up to $550 into the next year or a grace period of a few extra months to use up account funds. There are three basic types of FSA accounts as noted below.

Health Care FSAs are for eligible medical expenses not covered by a health plan such as:

Health Care FSAs are for eligible medical expenses not covered by a health plan such as:

- Insurance copays, dental care, chiropractic visits, eye care, prescription drugs, over-the-counter medicines, medical supplies, etc.

- Dependent Care FSAs cover eligible dependent care services for dependents (under age 13 or disabled of any age) such as:

- Dependent care in or outside the home, preschool tuition, summer day camps, after-school programs, senior daycare facilities, etc.

- Limited Purpose FSAs cover eligible dental and vision expenses if the employee is enrolled in a high-deductible health plan (HDHP) and has an HSA. Some eligible expenses are:

- Insurance copays for dental and vision care, Lasik, contact lenses, prescription glasses, prescription sunglasses, etc.

- Some plan designs allow for reimbursement of medical expenses after the deductible is met in the HDHP.

HEALTH SAVINGS ACCOUNT (HSA)

HSAs are a type of savings account that allow the account holder to set aside money on a pretax basis to pay for qualified medical expenses. HSA account holders must be enrolled in a qualified HDHP and can contribute up to the annual IRS limits into their HSA. Savers aged 55 and older can contribute above the IRS limits as a “catch up” contribution. Some employers also make contributions to HSAs for their employees.

HSAs are a great way to build up savings for health care costs in retirement because they “roll over” from year to year. Additionally, some plans like TRI-AD’s HealthSaver HSA offer mutual funds as an investment tool once the account reaches a certain savings threshold.

Account holders can use untaxed dollars to pay eligible expenses like deductibles, copayments, and coinsurance. HSAs offer triple tax savings for most states. Contributions, withdrawals, and earnings are tax-free in many states. Note: if HSA funds are used to pay for anything other than a qualified medical expense, that amount will be taxed as ordinary income, and an IRS penalty may be assessed.

Due to the tax savings, some account holders can save up to 35% on eligible expenses by using their HSA funds.

HEALTH REIMBURSEMENT ARRANGEMENT (HRA)

HRAs are employer-funded, employer-owned health benefit accounts used to reimburse employees for out-of-pocket medical expenses and, in some cases, personal health insurance premiums. There are various types of HRAs, some of which can be incorporated into group health coverage. Some employers use their HRAs for wellness/lifestyle accounts. Employees claim funds out of the plan on a tax-free basis after expenses are incurred. Since the plan is employer-funded, account holders generally either forfeit the funds or have a limited time to spend them should they leave their employer, are terminated, or retire. Employers receive a tax deduction for amounts funded to HRAs.

HRAs have a lot of flexibility in plan design, so employers can decide whether or not to allow funds to roll from plan year to plan year. This same flexibility allows employers the ability to refine which expenses are eligible for reimbursement through the HRA. Like FSAs and HSAs, HRAs are subject to IRS limits, depending on plan type.

CHOOSING THE RIGHT PLAN TYPE(S)

With so many options available to employees today, understanding the basics of each plan type can help employees make better benefits choices. TRI-AD’s Comparison Chart is a sharable reference guide that answers the most common questions about how each of these plans is structured, funded, and utilized.

TRI-AD and our Associates’ suggestions or recommendations shall not constitute legal advice. No content on our website can be construed as tax or legal advice and TRI-AD may not be considered your legal counsel or tax advisor. Clients are encouraged to consult with their tax advisor and/or attorney to determine their legal rights, responsibilities, and liabilities. This includes the interpretation of any statute or regulation, federal, state, or local; and/or its application to the clients’ business activities.