Consumers expect richer interfaces, predictive analytics, personalized interactions, and more meaningful guidance from the apps and platforms they regularly use. Instant access to personalized guidance and more educated decision-making creates a better employee benefits experience. Organizations that offer a better employee benefits experience have superior retention, recruitment, and productivity. Technology evolves rapidly. User expectations for the performance, capabilities, and functionality of benefits software keep pace with technology advancements.

TRI-AD uses best-in-class technology platforms that incorporate artificial intelligence (AI) to educate and guide consumers. We offer an AI personal benefits assistant who provides real-time support in over 20 different languages to participants 24/7 on our SaaS eligibility and enrollment solution. This assistant functions as an extension of our Participant Services Center on the web-based platform and mobile app. She answers employee questions instantly based on live data in the platform to decipher benefits jargon, locate educational and explanatory documents, and help the participant through their benefit enrollment journey. Our AI chatbot uses deep learning, automatic speech recognition, and natural language processing to understand the user’s needs, gain new insights, and provide more complex answers over time. As she engages with people and data, she recognizes patterns, and predicts future developments.

In late spring, our reimbursement platform will launch a next generation mobile app. This smart account approach is powered by AI to generate personalized health and wealth guidance. The enhanced mobile app uses technology to meet consumers and bridge the knowledge/usage gap leading to better outcomes. These exciting innovations will provide:

- Simple, easy-to-navigate experience

- AI-powered insights and recommendations

- Enhanced engagement and transparency tools

- Condition-based guidance

- HSA and non-HSA Smart Scores

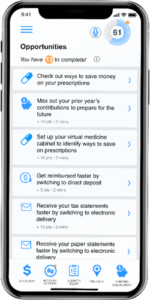

Smart account functionality offers funding advice tailored to health condition history and healthcare needs. An auto-optimize tool will be available for  open enrollment based on the health and wealth activity of the past year. Consumers can leverage AI-driven guidance for optimal selection and funding. The system will use historical spending to drive better future outcomes (e.g., “You might have paid too much for this service”). An easily accessible opportunities feed promotes activities that drive value to the consumer by prompting changes or suggestions that can save money and maximize tax savings. High levels of interaction with the app will deliver more personalized and more precise insights and higher Smart Scores. The higher the Smart Score, the better value a consumer is receiving on every dollar spent and saved.

open enrollment based on the health and wealth activity of the past year. Consumers can leverage AI-driven guidance for optimal selection and funding. The system will use historical spending to drive better future outcomes (e.g., “You might have paid too much for this service”). An easily accessible opportunities feed promotes activities that drive value to the consumer by prompting changes or suggestions that can save money and maximize tax savings. High levels of interaction with the app will deliver more personalized and more precise insights and higher Smart Scores. The higher the Smart Score, the better value a consumer is receiving on every dollar spent and saved.

At TRI-AD, we embrace AI and the opportunities it gives us to innovate and automate interactions with consumers to help them optimize their benefits choices which ultimately leads to better financial wellness. We have invested in best-in-class platforms which allow us to offer great technology. This powerful technology complemented by our exceptional client and participant support teams provides an unrivaled experience. Our mission is to make it fast, simple, and easy for you to manage your employer-provided benefits. At TRI-AD, we believe that helping people in the here and now to make good benefit decisions will impact their future happiness and success.

Integrated health and wealth benefits administration. That’s the TRI-AD difference.