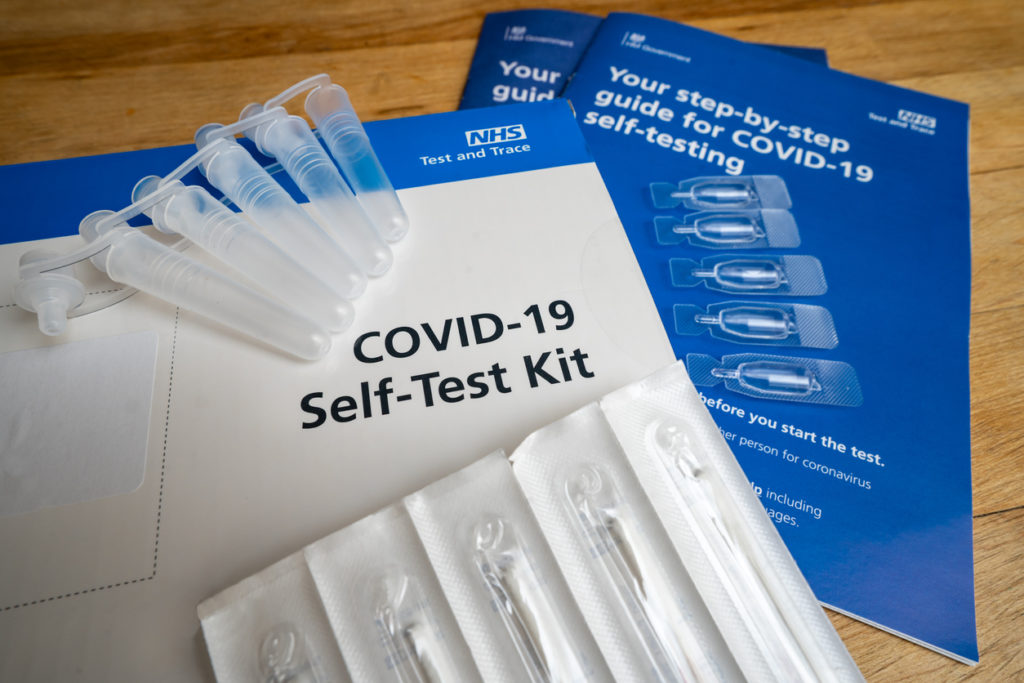

On September 10, 2021, the IRS issued a statement reminding taxpayers that the cost of home testing for COVID-19 is an eligible medical expense under health flexible spending arrangements (HFSAs), Health Savings Accounts (HSAs), Health Reimbursement Arrangements (HRAs), or Archer Medical Savings Accounts (Archer MSAs). The cost to diagnose COVID-19 is an eligible medical expense for tax purposes. Additional information can be found on IRS.gov.

The IRS also reminds us that the costs of personal protective equipment (PPE), such as masks, hand sanitizers, and sanitizing wipes, for the primary purpose of preventing the spread of COVID-19 are eligible medical expenses under HFSAs, HSAs, HRAs, and Archer MSAs. The cafeteria plan may need to be amended for this particular provision. Additional information can be found on IRS.gov and our blog about IRS PPE guidance.

TRI-AD’s COVID-19 Resource Page

TRI-AD and our Associates’ suggestions or recommendations shall not constitute legal advice. No content on our website can be construed as tax or legal advice and TRI-AD may not be considered your legal counsel or tax advisor. Clients are encouraged to consult with their tax advisor and/or attorney to determine their legal rights, responsibilities, and liabilities. This includes the interpretation of any statute or regulation, federal, state, or local; and/or its application to the clients’ business activities.