In the first quarter of 2020, enhancements backed by machine learning (ML) and artificial intelligence (AI) are coming to the TRI-AD Health Savings Accounts (HSAs). It’s one more way we endeavor to fulfill our purpose to enrich the health and financial well-being of people just like you.

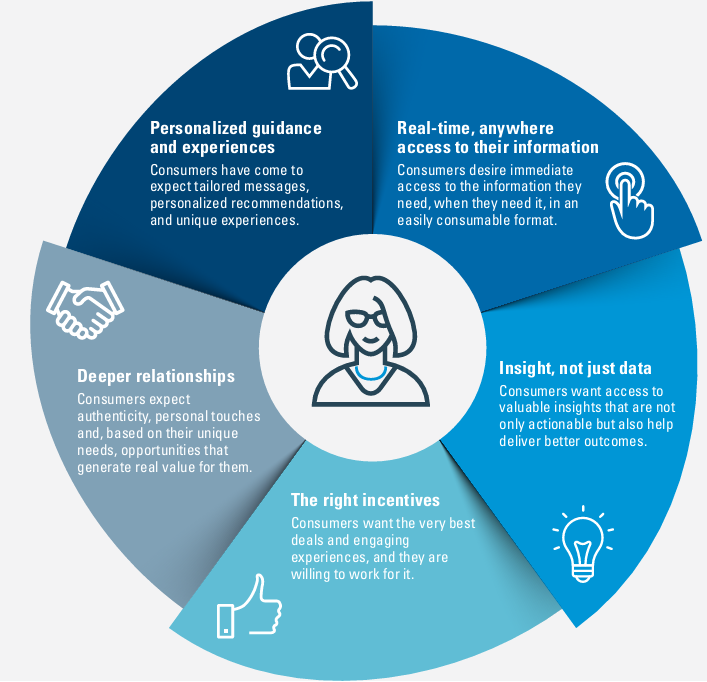

Consumers expect valuable personalized interactions and proactive service. They want access to comprehensive information to make decisions quickly and effectively. Both employers and consumers will benefit from this new approach to HSAs.

Value for Employers

- Cost savings: expanded premium and tax savings from greater HDHP account adoption

- Employee satisfaction: greater employee satisfaction and engagement

- Easy administration: low employee “noise” and easy self-service administration tools

Value for Consumers

- Better value: optimized spending and saving delivers better value for each member’s healthcare dollar

- Better decisions: easy to use tools that empower consumerism and take the guesswork out of healthcare decisions

- Customized experience: personalized guidance and education leads to greater fluency and confidence

The “Smart HSA” is the next generation of our existing HSA solution. It provides broader support for the benefits lifecycle and greater influence across the full spectrum of healthcare benefits. Further bolstering consumer-driven healthcare (CDH) plans, it will empower employees to make smart benefit choices during open enrollment and throughout the year to get the most value from every dollar they spend on out-of-pocket healthcare expenses. These enhancements will make it fast, simple and easy for employees to manage their employer-sponsored benefit plans.

The key “Smart HSA” features are:

- Data-driven tools, including a personalized “Smart Score,” that guide consumers to make intelligent choices on where to best spend and save their healthcare dollars

- AI-based recommendations that use historical spending to drive better future outcomes, e.g., “You might have paid too much for this service.”

- A virtual medicine cabinet for managing monthly drug costs

- Long-term saving recommendations based on healthcare spending habits, e.g., “You have a chronic condition that will require you to have X dollars saved for retirement.”

- A modern, native mobile interface that integrates new health management capabilities with existing CDH self-service capabilities

- Intelligent prompts throughout the app to optimize the member experience for existing self-service functions beyond HSAs, e.g., “It looks like you need to provide a receipt for your latest debit card swipe. (Limited Purpose FSA).”

- Year-end recommendations about funding and account enrollment that are based on the past year of health and wealth activity, e.g., “It looks like you didn’t hit your deductible or max out your HSA. Next year, we recommend the following funding levels.”

The Modern Consumer’s Wish List:

Watch for more information at the end of this year as the launch date for the “Smart HSA” approaches, and call your TRI-AD Client Service Manager with any questions.