Employers who offer a high deductible health insurance plan (HDHP) may offer an HSA. Health Savings Accounts have great benefits, including a triple-tax advantage in most states, and the ability to invest funds.

Account holders can enjoy one of the biggest benefits—the triple-tax benefit—which means contributions are tax-deductible, growth is tax-free, and the distributions are tax-free when used for qualified medical expenses. In addition, unlike a 401(k) or IRA, there are no rules to take money from the account at a certain age.

SubscribeLong-term tax-free investment growth can make a significant difference in the amount of money account holders retain. Like a brokerage account or an IRA, account holders can put pretax earnings into the account. When the account balance is over $1,000, they can start investing!

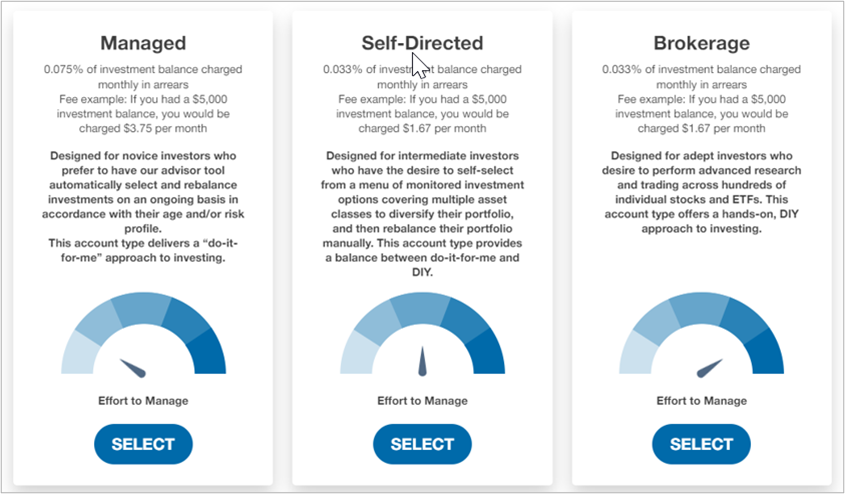

TRI-AD offers three unique investment paths with our TRI-AD HSA solution, Managed, Self-Directed, and Brokerage accounts. Account holders can tailor their investment journey to fit their individual needs and experience level.

In a move that would allow more individuals to save more for their health care expenses in retirement, the House Ways and Means Committee, approved legislation on September 28th, 2023, to significantly expand HSA contribution limits as well as broaden the number of individuals eligible for HSAs. TRI-AD is following the progress of the HSA bills in Congress.

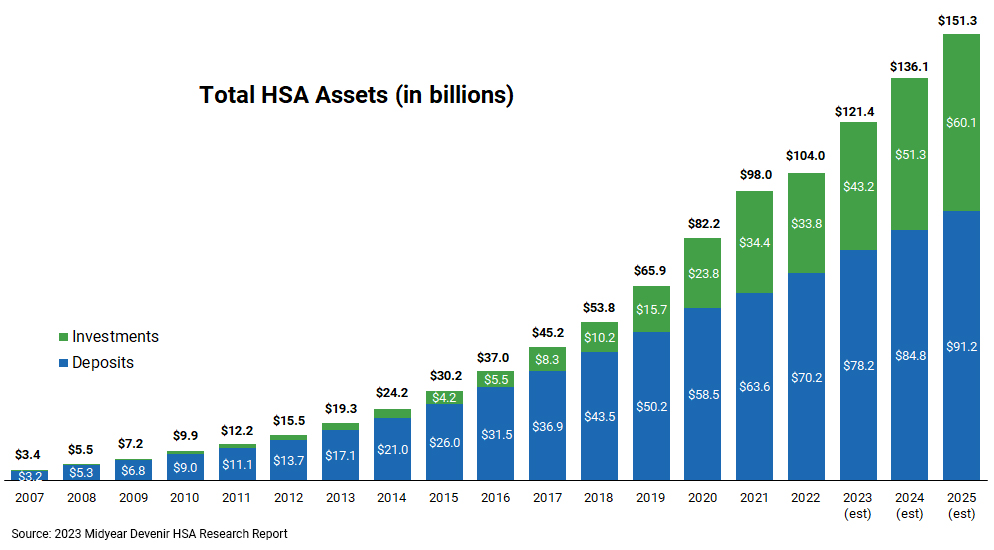

HSA accounts are growing in popularity. Devenir reported that there was about $116 billion saved in almost 36 million HSAs at the halfway point of 2023. Projections indicate that at the end of 2025 the HSA market will exceed 40 million accounts, holding over $150 billion in assets.

HSAs are an effective savings tool that can help lower account holders’ taxes, pay for health care more easily, and save for retirement healthcare expenses. Generally speaking, at age 65, the funds may be used for any purpose without a penalty.

TRI-AD makes it fast, simple, and easy for clients to add an HSA to their benefits offering. HSAs allow individuals and families to pay for rising health costs and have a better financial outcome in the future. They can be an essential piece of a comprehensive wealth-building strategy.

Contact our sales team to find out more about this valuable benefit.

TRI-AD and our Associates’ suggestions or recommendations shall not constitute legal advice. No content on our website can be construed as tax or legal advice, and TRI-AD may not be considered your legal counsel or tax advisor. Clients are encouraged to consult with their tax advisor and/or attorney to determine their legal rights, responsibilities, and liabilities. This includes the interpretation of any statute or regulation, federal, state, or local; and/or its application to the clients’ business activities.